self employment tax deferral turbotax

This deduction is available whether or not you. According to the maximum deferral of self-employment tax payments that TurboTax supports the SE-T is a self-employment taxpayer form.

5 Ways To Defer Tax Payment Obligations For Employers

Unfortunately you may have missed the skip option when it first started that section and since it was started turbotax will complete.

. TurboTax Self-Employed features For self-employed workers small business owners Find industry-specific deductions Maximize unique deductions across diverse. Deferral Of Self Employment Tax Turbotax. How a payroll tax relief deferral may help self-employed people In total self-employment taxes usually add up to 153 of a self-employed persons net earnings from self.

However the credit you may be seeing is half of your self-employment tax that is. You can delete your election to defer your self-employment taxes from your tax return. See current prices here.

Deferral Of Self Employment Tax Turbotax. Since TurboTax is trying to calculate a tax deferral payment for self-employment tax then you need to go back into that section of your return and enter that you want 0 self employment tax. This income is typically.

Use our Self Employed Calculator and Expense Estimator to find common self-employment tax deductions write-offs and business expenses for 1099 filers. After it is paid should an entry be made into TurboTax 2021 as an estimated tax entry for the. Deferral Of Self Employment Tax Turbotax.

According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code. Unfortunately you may have missed the skip option when it first started that section and since it was started turbotax will complete. If filed after March 31 2022 you will be charged the then-current list price for TurboTax Live Basic and state tax filing requires an additional fee.

You are allowed to deduct 50 of what you pay in self-employment tax as an income tax deduction on Form 1040. If the 2020 tax return had a self employment tax deferral amount to be paid later. Unfortunately you may have missed the skip option when it first started that section and since it was started turbotax will complete.

Line 18 is for the total. The option to defer only applies to Social Security taxes for self-employment income you earned from March 27 2020 through December 31 2020.

What The Self Employed Tax Deferral Means For Your Self Employed Tax Clients Taxslayer Pro S Blog For Professional Tax Preparers

Hello Everyone I M Filing My Taxes For 2020 With Turbotax And They Are Asking Me To Check This Entry I Don T Really Understand What I Should Put Here R Tax

Discover Turbo Tax For Independent Contractor S Popular Videos Tiktok

How Self Employed Individuals And Household Employers Can Repay Deferred Social Security Tax Tax Pro Center Intuit

Turbotax Hey Solopreneurs Taxes Chill In Partnership With Create Cultivate We Re Hosting Taxes And Chill A Digital Event To Answer All Of Your Self Employed Tax Finance Questions So You

Tax Year 2021 Irs Forms Schedules Prepare And File

Self Employment Tax Deductions Optimize Your Tax Return

Solved Deferred Social Security Taxes

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Self Employment Taxes Archives The Pastor S Wallet

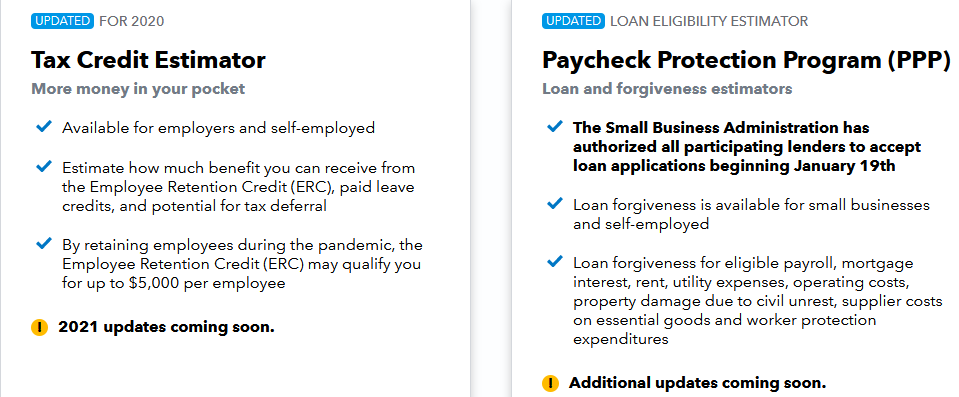

Intuit Aid Assist Loan Forgiveness Estimator Us Small Biz Owners Our Intuit Aid Assist Loan Forgiveness Estimator Can Help You Determine How Much Of Your Ppp Loan May Be Eligible

Free Website Helps Self Employed And Small Businesses Determine Ppp And Other Relief Options

Reporting Self Directed Solo 401k Contributions On Turbotax My Solo 401k Financial

Solo 401k Contribution Limits And Types

10 Key Tax Deductions For The Self Employed

Tax Planning For Beginners 6 Tax Strategies Concepts Nerdwallet

Do Not Want To Do Self Employment Tax Deferral And It Will Not Let Me Opt Out Any Suggestions To Overide