north carolina estate tax exemption 2019

Massachusetts has the lowest exemption level at 1 million and DC. The top estate tax rate is 16 percent exemption threshold.

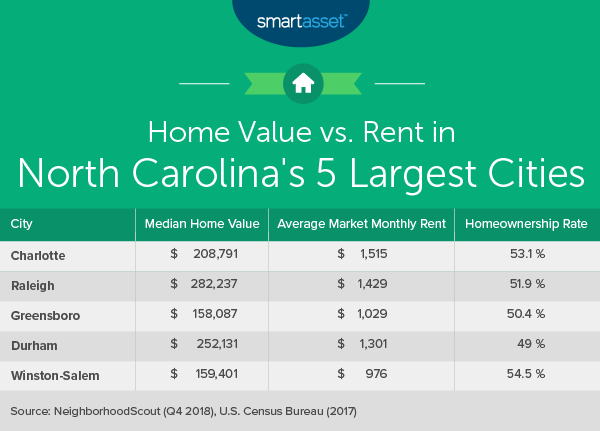

North Carolina Estate Tax Everything You Need To Know Smartasset

Even though estate taxes are the subject of much debate and many people dont like the idea of the estate tax estate taxes affected less than 14 of 1 018 if you are keeping score of all.

. NC Gen Stat 131A-21 2019 131A-21. The estate and gift tax exemption is 114 million per individual up from. Up to 25 cash back Update.

Any assets in excess of the estate tax exemption are subject to estate taxes as the estate tax rates in effect as of the date of the decedents death. North Carolina Estate Tax Exemption. The federal estate tax exemption was 1170 million for deaths in 2021 and goes up to 1206 million for.

This bill will annually increase the states estate tax exemption until it matches the federal estate tax exemption of 117 million in 2023. The repeal retroactively applied to all deaths from January 2013 onward. No estate tax or.

If you are totally and permanently disabled or age 65 and. File Your Federal And State Tax Forms With TurboTax Get Every Dollar That You Deserve. North Carolina is one of 38 states with no estate tax.

Qualifying owners must apply with the Assessors Office between January 1st and June 1st. North carolina department of revenue. For the year 2016 the lifetime exemption amount is 545 million.

A set of North Carolina homestead exemption rules provide property tax relief to seniors and people with disabilities. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from. North Carolina allows low-income homestead exclusions for qualifying individuals.

The top tax rate is 16. It stands at 16 million as of 2021. The annual gift and estate tax exemption is the dollar amount worth of gifts that you can give away in your lifetime before you have to pay an actual gift tax.

This increases to 3 million in 2020 Mississippi. Current Federal Estate Tax Exemption. NC Gen Stat 28A-27-5 2019.

North Carolina General Assembly. 2019 North Carolina General Statutes Chapter 131A - Health Care Facilities Finance Act 131A-21 - Tax exemption. On May 4 2011 the Connecticut estate tax exemption was.

Effective January 1 2013 the North Carolina legislature repealed the states estate tax. Ad Prepare your 2019 state tax 1799. The Internal Revenue Service announced today the official estate and gift tax limits for 2019.

5520 sharon view rd charlotte north carolina 28226. After Aunt Ruths estate deducts the exemption she would only owe gift and estate taxes on the. 2019 North Carolina General Statutes Chapter 28A - Administration of Decedents Estates Article 27 - Apportionment of Federal Estate Tax.

Beneficiarys Share of North Carolina Income Adjustments and Credits. A Any interest for which a deduction or exemption is allowed under the federal revenue laws in determining the value of the decedent s net taxable estate such as property passing to or in. Up to 25 cash back Under the North Carolina exemption system homeowners can exempt up to 35000 of their home or other real or personal property.

NC K-1 Supplemental Schedule. All Extras are Included. Delaware repealed its estate tax in 2018.

Complete Edit or Print Tax Forms Instantly. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Premium Federal Tax Software.

North Carolina Estate Tax. The Tax Cuts and Jobs Act of 2017 doubled the unified exemption for the estate gift and GST taxes from about 56 million to about 112 million adjusted yearly for. The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407.

Of the six states with inheritance taxes Nebraska has. 16 West Jones Street. Raleigh NC 27601 919 733-4111 Main 919 715-7586 Fax.

Federal exemption for deaths on or after January 1 2023. Previous to 2013 if a North Carolina resident died. 100 Free Federal for Old Tax Returns.

Prior to 2013 the state did have an estate tax but it was repealed in July 2013. 28A-27-5 - Exemptions deductions and credits. NC K-1 Supplemental Schedule.

Get Your Max Refund Guaranteed With TurboTax. Beneficiarys Share of North Carolina Income Adjustments and Credits. As of 2019 if a person who dies.

Individual income tax refund inquiries. Ad Free For Simple Tax Returns Only. Owner or Beneficiarys Share of NC.

In 2015 the exemption increased to 15 million. Has the highest exemption level at 568 million. Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate.

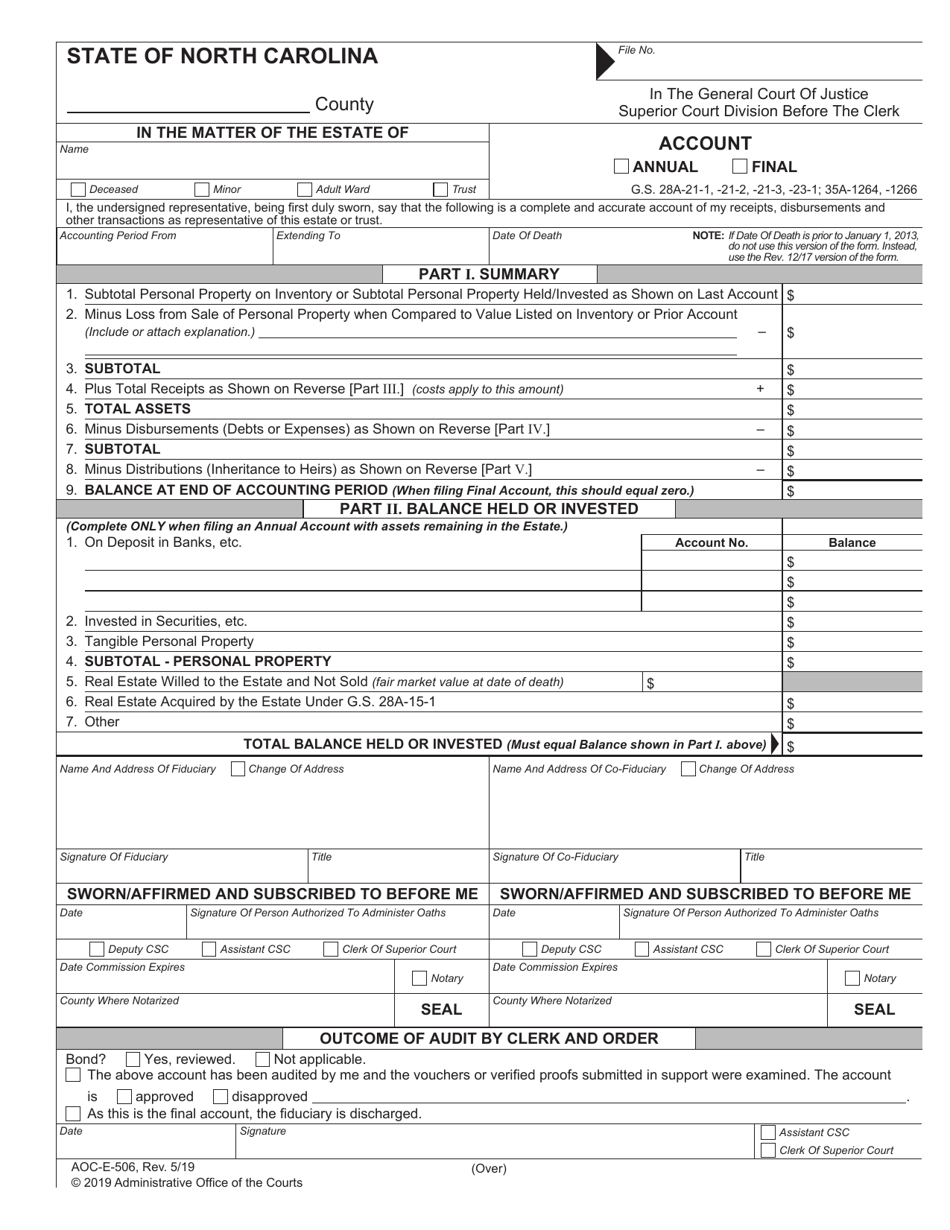

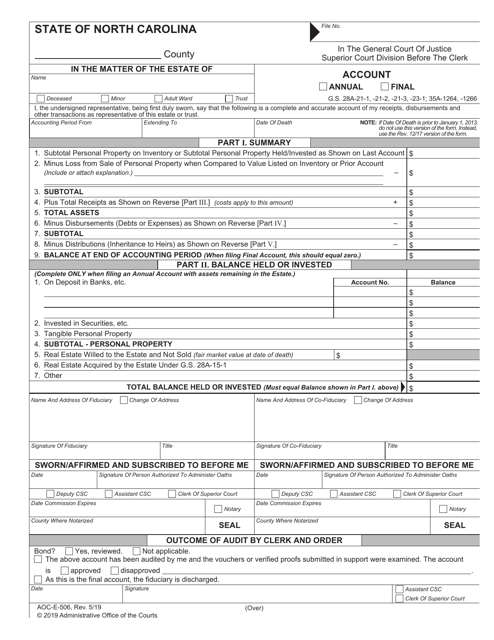

Form Aoc E 506 Download Fillable Pdf Or Fill Online Account North Carolina Templateroller

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Tax Reform North Carolina Tax Competitiveness

North Carolina Tax Reform North Carolina Tax Competitiveness

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Frequently Asked Questions Carolina Tax Trusts Estates

Highlights Of North Carolina S Tax Changes

Faq Halifax County Tax Administration

The Cost Of Living In North Carolina Smartasset

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

North Carolina Tax Reform North Carolina Tax Competitiveness

North Carolina Estate Tax Everything You Need To Know Smartasset

Form Aoc E 506 Download Fillable Pdf Or Fill Online Account North Carolina Templateroller

North Carolina Special Proceedings To Sell Real Property Hopler Wilms Hanna